Synthetic

Invest in a financial instrument without committing to a full and direct investment.

Amber Markets, is your premier destination for innovative trading solutions.

As a regulated online brokerage, we offer synthetic trading—an advanced strategy allowing traders to benefit from financial markets without full ownership of assets. Whether you’re a seasoned investor or new to trading, Amber Markets provides the tools and expertise to navigate synthetic trading with confidence.

What Is a Synthetic Trading Strategy?

It is a strategic approach that helps to gain benefits from investing in a financial instrument without committing to a full and direct investment. This type of trading utilizes synthetic instruments, which are a type of financial asset designed to mimic other financial assets. A synthetic position results in the same payout as another financial instrument while having different characteristics.

To illustrate, consider this example of synthetic trading: Suppose you want to acquire shares of XYZ, currently priced at $1,000 per share. Instead of purchasing these shares outright, you could opt for a synthetic position. This involves simultaneously buying a call option and selling a put option at a strike price of $1,000. This maneuver effectively mimics the effects of owning the stock directly, without actually committing to the full investment.

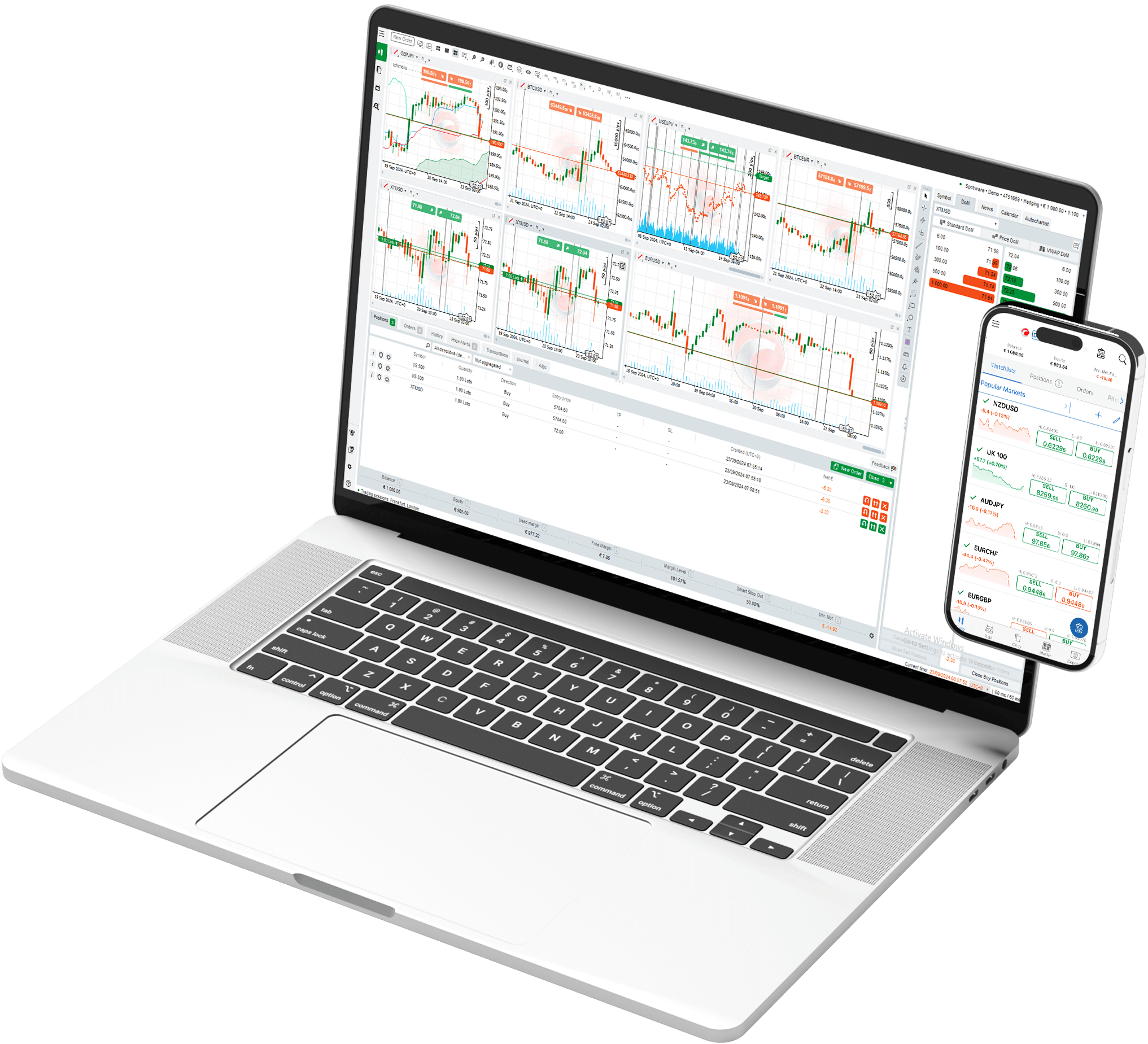

Trade up to 16 CFDs with Amber Markets in a safe and secure online environment, anywhere.

Amber Markets Platform is available for use on desktop, tablet, and mobile.

Scan to Download Android App

Frequently Asked Questions

As the stock market is highly volatile, stock prices can fluctuate considerably from time to time which can lead to both large profits and losses. Similarly, leveraging such underlying securities through derivative contracts can also amplify the gains just like it can also magnify losses.

A synthetic call or put acts like a regular call or put option, offering the chance for unlimited profit and limited loss, but without needing to choose a specific strike price. Also, synthetic positions help control the risk that comes with cash or futures trading, which can be unlimited if not managed properly.

There are a total of six types of synthetic options which include: Synthetic Long Stock, Synthetic Short Stock, Synthetic Long Call, Synthetic Short Call, Synthetic Long Put, and Synthetic Short Put.