Commodities

Amber Markets provides high-level services in the commodity market with qualified expertise in risk management.

| Instrument | Description | Average Spread (Pips) |

|---|---|---|

| USCRUDE | US Crude Oil Spot | 0.3 |

| UKCRUDE | UK Crude Oil Spot | 0.3 |

| CRUDE_ YY | US Crude Oil Future | 0.25 |

| BRENT_QYY | UK Crude Oil Future | 0.25 |

| NATGAS_YY (Future) | US Natural Gas Future | 0.14 |

What is Commodity Trade?

In simple terms, a commodity can be defined as a group of assets like food, energy, or metals. They are the building blocks of the global economy. Other categories of commodities include energy, livestock, agriculture, etc. We at Amber Markets, allow you to trade different commodities like wheat, natural gas, crude oil, wheat and many more.

In order to diversify your portfolio, commodities are a great way. Even if prices tend to move in opposition to stocks and shares, they will play a vital role in the global economy. Some of the exchanges where commodities trade takes place include Contract For Difference (CFD) i.e. trading the asset at an agreed price and date in the future.

Trading commodities has been around for generations and with the help of brokerages such as it’s never been easier. Commodities are traded on several exchanges, generally as futures contracts or as a Contract For Difference (CFD), which means you’re trading the asset at an agreed price and date in the future. CFD trading enables you to trade the contracts, without ever having to own the underlying asset.

One of the advantages of CFD is that it enables you to trade the contracts even underlying your own assets.

There are different advantages associated with commodity trade. Some of them are – one can trade with a wide range of commodities with the tightest spread in the market. No restrictions on EA, no price slippage, no requotes, and no rejections. The margins required are low.

For a commodity trade, access to free VPS, MAM, and PAMM accounts. We offer complete transparency of the market with the best bids/offers displayed.

Trade up to 16 CFDs with Amber Markets in a safe and secure online environment, anywhere.

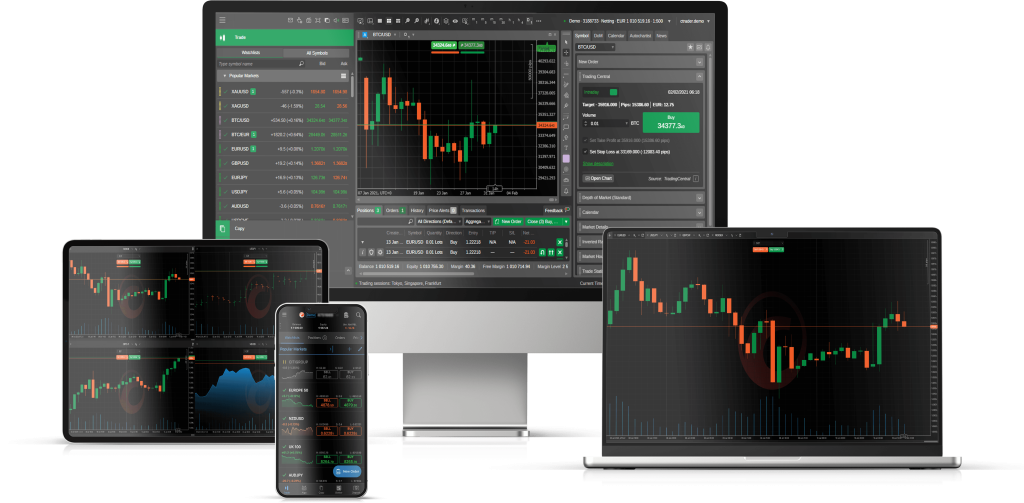

Amber Markets Platform is available for use on desktop, tablet, and mobile.

Scan to Download Android App

Frequently Asked questions

Amber Markets allows you to buy and sell commodities with Contracts for Difference (CFDs). This enables investors to profit from both a dip and a rise in price as you are speculating on the difference in price from the moment the contract begins to when it ends. You can also protect yourself from potential losses by defining stops and limits to close your position when it hits a pre-determined rate.

A great way to diversify your portfolio is by investing in natural gas and crude oil. As demand grows investors can make a profit on their initial investment. Amber Markets guarantees its clients there’s no price slippage, no requote, and no rejections and offers Negative Balance Protection, safeguarding you from potential losses.

Crude oil and natural gas are the world’s most traded commodities, both of which can be traded with Amber Markets. Other popular commodities include soybeans, corn, gold, copper, coffee, and silver. Prices can change quickly giving traders a great opportunity to profit from both positive and negative price movements.

Amber Markets enables its clients to begin trading commodities on Amber Markets Trader, with a minimum account size of $100.

News & Blogs

Enabling you with Right Information at Right Time