CFDs

Step into a world of unlimited opportunities, where you can trade without constraints and seize endless possibilities.

Step into a world of unlimited opportunity, where you can trade without constraints and seize endless possibilities.

At Amber Markets Trading, we offer you access to over 16 CFDs, providing swift and cost-effective execution in a secure trading environment. Our user-friendly online platform is equipped with a variety of tools to support your trading strategy and help you make the most of your investments.

What is CFD Trading?

CFD trading involves a contract between a buyer and a seller wherein the buyer agrees to pay the seller the difference between the current value of an asset and its value at the time of the contract.

It allows traders and investors to capitalize on price movements without owning the underlying assets. The value of a CFD is solely based on the price change between

This type of trading operates through a contractual agreement between the client and the broker, bypassing the need for involvement with traditional stock, forex, commodity, or futures exchanges. CFD trading offers several significant advantages, contributing to its widespread popularity over the past decade. The opening and closing of the trade, disregarding the underlying asset’s actual value.

Trade up to 16 CFDs with Amber Markets in a safe and secure online environment, anywhere.

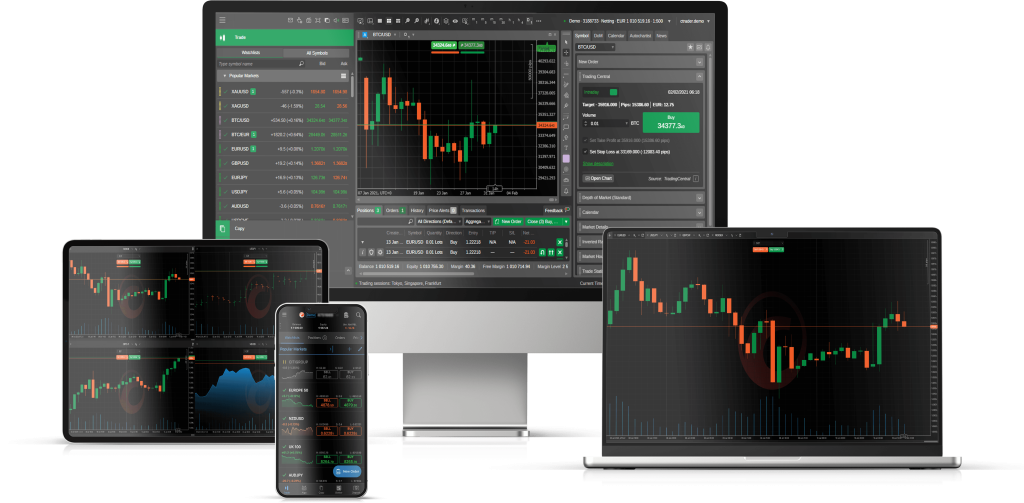

Amber Markets Platform is available for use on desktop, tablet, and mobile.

Scan to Download Android App

Frequently Asked Questions

When trading a CFD, you enter into a contract with a broker to exchange the difference in the price of the underlying asset between the opening and closing of the contract. If you believe the market price of the asset (e.g., forex currencies, stocks, commodities) will rise, you can go long (buy), and if you expect it to fall, you can go short (sell). The profit or loss is determined by the difference in the price movement of the asset in the open market.

CFD trading works by allowing you to speculate on the price movements of a financial instrument without having to take ownership of the underlying asset. If the market price of the asset moves in the same direction as your CFD trade, you will make a profit.

A key advantage of CFD trading is the accessibility it provides to a wide range of markets and assets. With CFDs, traders can access various financial instruments, including stocks, indices, commodities, and currencies, all from a single trading platform.

As with any financial instrument or investment, trading CFDs comes with a risk. The use of leverage can make CFDs riskier than non-leveraged products, such as physical shares. Before you start trading with a live account, you should familiarise yourself with those products, practise in a risk-free environment, and learn more about risk management.